Equal Exchange: Creating Non-Voting Investor Shares For Co-ops.

This case study was written in 2020 by Greg Brodsky and Shahzaib Azhar based on interviews with Equal Exchange employees and publicly available documents for the benefit of Start.coop accelerator participants and the broader co-op community.

Location: West Bridgewater, MA

“It took us 20 years to become an overnight success.”

Founding

Equal Exchange was founded in 1986 by Rink Dickinson, Jonathan Rosenthal, and Michael Rozyne who met while working at Northeast Coops, a Boston MA food distributor owned by area grocery co-ops. The founders were looking to empower farmers at the bottom of the global food system, paying those farmers higher prices while still being viable in the marketplace. And, they also set out to create a model organization that combined the best of cooperatives, business and nonprofits. They dreamed of revitalizing people’s food experience by creating a more transparent and vital connection between farmers and consumers. In other words, a more equal exchange.

Since that time, Equal Exchange has become one of the biggest worker cooperatives in the US. In 2019, it had $80 million in sales and $1.8 million in profits.

Business Model

Equal Exchange buys fair-trade coffee, cacao, bananas, avocados, dried fruit, nuts, olive oil and other goods from small farmers around the world. It processes these raw materials either directly or through partners, and then sells finished products via distributors, retail stores, restaurants and cafes, and direct to the consumer via the web or through buying clubs. Equal Exchange's coffees, teas, chocolates, and other fair trade foods are available nationally through grocery stores, co-ops, supermarkets, cafes, restaurants, universities, and offices.

Coffee and chocolate account for about 80% of revenues. Equal Exchange imports containers of unroasted coffee from dozens of farmer co-operatives in Latin America, Africa, and Southeast Asia. It negotiates supply contracts for these containers up to eight months in advance. Then it sells the processed coffee and chocolate to a distributor and retail partners.

Structure

Originally, Equal Exchange was structured as an S corporation to give its initial investors a small tax advantage (writing off early losses). Once they were headed to break even, they converted to a C Corporation, Subchapter T by 1990. (Subchapter T is the only section of the IRS tax code that relates to cooperatives). Co-op statutes were not adopted in Massachusetts until the mid-1990s, and the company decided that it was unnecessary to reincorporate, as its history, behavior, and bylaws were sufficient to be treated by the IRS as a co-operative.

Equal Exchange is one of the few cooperatives that has chosen to make both its by-laws and investor term sheets available for others to learn from.

Worker-Owner Class A Shares

Equal Exchange is 100% owned by its employees. In 2020, they had 145 total employees (130 worker-owners who own Class A Shares, and 15 temporary or worker-owner track employees who are not yet owners).

Here is how Class A employee shares work:

Class A common stock, which is only open to employees, entitles shareholders to patronage based profit sharing and also makes them a voting member of the co-op. An employee is eligible to join the cooperative as an owner after a full year of employment.

After an employee has been approved to join the co-operative by at least 80% of the current worker-owners (which typically happens at the beginning of the employee's second year) they agree to purchase one share of Class A stock. Class A stock share currently costs $3,870, and its price is indexed to inflation. Worker-owners are given a 4-year, interest-free loan to cover the stock purchase, the loan payments are deducted from employees’ biweekly paychecks.

When a worker-owner leaves Equal Exchange, they must sell the share back to the co-operative at the same price they paid for it. They can not sell the share to anyone else.

From the annual profits received by workers, they have voted to put 50% of their portion into a joint account that invests in the class B shares. This account currently has over $1.8 million, making the employees, as a group, the largest owner of Equal Exchange’s preferred shares.

The employees have adopted by-laws that prohibit employees and investors from ever cashing out by selling the company. Any net proceeds from a sale are to be donated to another alternative trading organization. Neither the co-op members nor the outside investors would be able to keep the money from a sale.*

Need For Capital

Due to their fair trade business model, Equal Exchange has an inherent need for outside capital to pre-pay farmers every year. Specifically, their fair trade business model means they pay farmers long before their end-user customers (distributors, stores, and consumers) pay Equal Exchange. Conventional companies typically pay 90 days or more after the farmers have delivered the coffee or other raw materials. Equal Exchange pays farmers in full when the coffee is shipped. As a result, Equal Exchange absorbs the inventory risk from the farmers, which creates a much higher inventory on hand than the competition.

In the early days, EE had as much as fourteen months inventory of green coffee (compared to a one month average for the rest of the industry) which required a tremendous amount of upfront cash to support their business model. The company currently has an average of nine months of unroasted coffee during the year, as well as large quantities of chocolate products and other goods. As the company has grown, it has also needed to invest several million dollars into other capital expenses like a 77,000 square foot warehouse and roastery, two coffee roasters, a quality control lab, forklifts, and packaging equipment.

Class B Investor Shares

In order to provide the necessary capital to solve their cash flow problem, in 1989 Equal Exchange created a share class for outside investors. They were an innovator in creating a preferred non-voting investor share class for co-ops.

Over the years, Equal Exchange has raised mission-aligned financing from over 550 people and institutions that share the company’s values, and who want to help it grow without ever putting those values at risk, or undermining the absolute control of Equal Exchange’s 130+ worker-owners. Exchange co-founder Michael Rozyne adopted the model from an ICA Group model, which was adapted for the US from the Mondragon Cooperatives in the Basque Region of Spain. Attorney Clark Arrington, who worked at Equal Exchange, helped in developing the model further.

Here is how the Class B investor shares work:

Investors buy shares of Equal Exchange Class B investor stock. These shares pay a fixed dividend. It is equity, but in function the shares act much like debt. The per-share purchase price is fixed at $27.50, which is an arbitrary number (it does not correspond to the company’s Net Asset Value or “valuation”). The minimum purchase per investor is $10,000 (363.636 Shares).

In order for Equal Exchange as a private company to issue unregulated securities, they use a Rule 506b exemption under Regulation D which limits each offering to 35 non-accredited “sophisticated” investors, but an unlimited number of accredited investors.

Each share purchased offers investors a yearly 5% “target dividend”. The return isn’t guaranteed, though, and has varied between 3% and 8% since 1989, depending on financial performance, and has averaged 5.18% over 30 years. Equal Exchange has declared and paid dividends on its Preferred Stock every year for the past 30 years.

Stocks have to be held for at least five years, and can only be sold back to the company (there is no secondary market). Preferred stockholders are discouraged from redemption before 5 years and the company can charge a penalty. Equal Exchange’s bylaws state that after year 2, shares can be redeemed at 70%, year 3 at 80%, year 4 at 90% and after year 5 at 100% of the value of the share price. Investors may request redemption after year 5 or can keep their holdings.

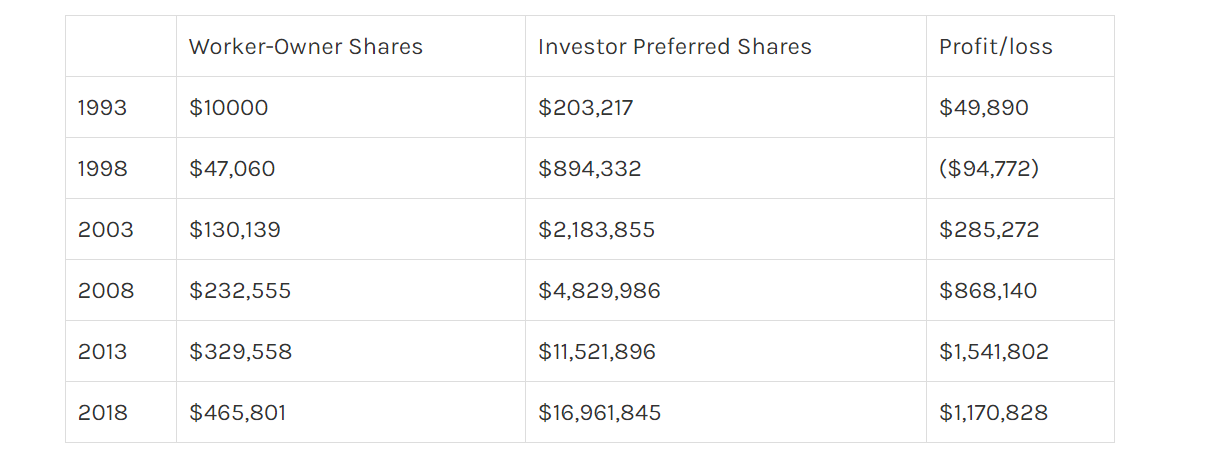

EE has raised $17 million in preferred stock capital using this model as of December 2019. (Exhibit-1 outlines the overall growth of Class-B share from 1989-2015.)

Traditional Investor: Look for “market rate” returns of 8-12%

Equal Exchange Investor: Receive a max of 8% return with a non-guaranteed target of 5% (roughly comparable to fixed income or bonds)

Growth

As the company sales have grown, the need for inventory has also grown proportionally, so while the 5% target dividend is expensive, the Equal Exchange fair trade business model means they will always have a need for outside cash to pre-fund each year’s expected volume. In 2019 that meant they needed to front roughly $19 million in inventory costs. (The company’s retained earnings are around $6 million, so they can’t afford to pay for inventory solely out of what they have on hand, nor would it be fiscally wise to spend all their cash on hand).

Having a lot of outside equity on the balance sheet makes Equal Exchange much more attractive to lenders, it looks less risky, and therefore reduces their cost of outside loans. Using this model, Equal Exchange has been able to partner with local banks and alternative lenders to gain access to additional operating capital.

Access to the capital on co-op friendly terms has allowed them to expand beyond their signature product, coffee, and add new product lines like organic, Fair Trade chocolate, tea, bananas, avocados, olive oil, nuts, and dried fruit. Here are a few of specific uses of capital they have raised:

Acquisition of green coffee inventory and finished chocolate and tea inventory.

Acquisition of inventory of new Fair Trade products.

Purchasing a warehouse, coffee roastery, and manufacturing and shipping equipment.

Making loans to and/or investments in other businesses to further the cooperative movement in the United States or abroad.

Being a worker-owned cooperative and using their edge of the market approach, Equal Exchange’s management never tried to grow too fast. However it was generally agreed by the staff that growth was important in order to have a larger impact. So generally, 15-20% yearly growth was seen as ideal for internal systems, available cash on hand, etc. although this rate has slowed during economic downturns and as a result of increasing market competition.

Challenges in Using This Model: “Concessionary Terms”

Even among the subset of investors who would describe themselves as “impact investors,” generally two-thirds are looking for market-rate returns. In other words, only one-third of investors with a self-declared social investing purpose are likely to participate once an investment offers below-market returns.

When Equal Exchange was still in its early years, offering only a non-guaranteed 5% dividend made it difficult to get enough working capital. By 1992, they were only able to achieve $203,137 in preferred shares, and investment volume only really scaled up after their first full decade of business. (See Exhibit-1).

Equal Exchange intentionally did not offer the most investor-friendly package. Original co-founder Jonathan Rosenthal explained “The idea, taken from worker co-op precedent, was that capital was a tool we were borrowing. So, Equal Exchange attempted to remove as much speculative gain from that capital as the investing market would bear. The original target group - socially responsible investors - were always hard to bring into Equal Exchange. The investment lack of an easy exit, the lack of potential strong upside, and our anti-capitalist culture all made it very hard for us to recruit investors.”

While Equal Exchange was waiting for its investor shares to gain traction, sales growth might have been stalled, fortunately Equal Exchange had success taking loans from a handful of high impact investment funds run by faith-based communities.

It took Equal Exchange a full 10 years to raise its first million dollars in outside investor shares, which meant slower and more organic growth. However the Equal Exchange team remained committed to showing there was a better, less extractive, way to raise capital for operations. Fortunately for them, they had developed their borrowing side as well. Over the years, as company success proved out their track record, more and more of the socially responsible investors finally participated.

After the financial crisis of 2008 decimated traditional public market stock returns, the Equal Exchange 5% target dividend suddenly looked like a very wise investment. Many investors realized that a consistent 5% was a wonderful return in an era of economic uncertainty. “It took us 20 years to become an overnight success” commented Equal Exchange Capital Coordinator Daniel Fireside. They currently have about 550 investors and have sold over $17M in preferred stock.

In order to manage its relationships with outside investors Equal Exchange created a full-time Capital Coordinator position early on in its operations. Fireside, who took over the position in 2010, often explains to cooperative entrepreneurs how much time he takes with each investor to make sure they really understand the intent and limitations of the preferred share structure, and that investors understand all their investment risks upfront.

Fireside has learned from experience that the most important way to cultivate investment is by building relationships with values-aligned people. When talking to potential investors, he reminds them that “all investment is risky, but at the end of the day, whether you make money on your investment or lose it all, it’s nice to feel good about what your money is doing in the world”.

While it would be easier to just send investors a check each year, Fireside communicates with investors on a regular basis, helping them to see why they should be excited about their investment, and telling real stories about the impact—by being as specific as possible. Here are example annual reports that Equal Exchange sends to their investor community.

Exhibit-1 Growth of Equal Exchange Preferred Stock

Exhibit-2 Growth of Equal Exchange Sales

Other Sources of Funds

Loans from mission aligned sources: Since Equal Exchange has twice as much equity as debt, as well as a strong sales record, it now has the option of picking possible lenders. Yet, it also seeks to align their borrowing with their social mission. In 2012 it split with its main commercial bank, which had controlled its lending operations, taking out a mortgage with non-profit lender RSF Social Finance, a line of credit backed by its receivables with the National Cooperative Bank, a line of credit with Eastern Bank, a local mutually-owned bank, and adding a large uncollateralized loan from the Cooperative Fund of New England. Some of the rates are slightly higher than they could have gotten by going with a large commercial bank, but the company decided to prioritize its borrowing with entities that recycled the funds back into the local and co-operative economies.

Workers retained earnings are also invested in the co-op’s future: Equal Exchange also counts over $6 million in retained earnings, which represents the cumulative profits that workers have reinvested annually since it first made a profit in 1989. Each year, worker-owners reinvest 60% of net profits.

Exhibit-3 Equal Exchange Capital Mix

The Legacy

Mission-aligned capital has fueled Equal Exchange’s growth to $80 million+ in annual sales (see exhibit-2 for overall sales growth over the last 30 years). As part of this growth, Equal Exchange owns a 77,000 sq ft warehouse and roasting facility in West Bridgewater, Massachusetts. In addition, it operates smaller offices in Minneapolis and Portland, Oregon. Equal Exchange also operates cafés in Boston and Seattle.

Most people who help finance the Equal Exchange value social return. The annual report is part of how they deliver what they call the “social return.” It’s how the investor community can learn about all the ways they are working to support a healthy regenerative food system, cooperative democracy, and authentic and meaningful Fair Trade in ways that don’t fit into a balance sheet or income statement.

In the last few years, radical shifts in the food retail marketplace (i.e. Amazon), and the growth of private label products within the Amazon subsidiary Whole Foods has been a major factor in slowing EE's growth. They are no longer growing at historic rates, but have seen strong growth in new categories such as fair trade bananas and avocados.

The impact for coffee growers is that Equal Exchange gives farmers the best terms, pays the most cash upfront and gives the most support compared to other growers. Many growers see Equal Exchange as the best supply chain partner (even within fair trade suppliers). “Equal Exchange, they have a vision that goes far beyond just fair trade” commented a producer partner from the Manos Campesino cooperative whose coffee ends up in the Organic Guatemalan Medium 5-pound bags.

The impact on employees is lower turnover, increased worker voice in company decisions, and the ability of workers to build up retained earnings that they can cash out upon leaving the company or in retirement.

Similarly a new generation of cooperative entrepreneurs has benefited from Equal Exchange’s work in creating mission-aligned working capital through preferred investor shares.

Exhibit-4 The Snapshot of 25-year Progress

*The Equal Exchange No Sell-Out Clause:

Early on, the Worker-Owners of Equal Exchange realized that the mission of the company was threatened not only by failure, but by success. Many successful mission-driven companies with outside investors either become a public company (owned by investors focused only on maximizing financial returns) or sell to a larger conglomerate. The original mission and control are often lost. To avoid this scenario, the company included a clause in its bylaws and Articles of Organization that effectively prohibit such a move. In the event of a sale or “demutualization”, the net proceeds from a sale are to be donated to another company dedicated to fair trade. The current shareholders would only receive the face value of their investment.